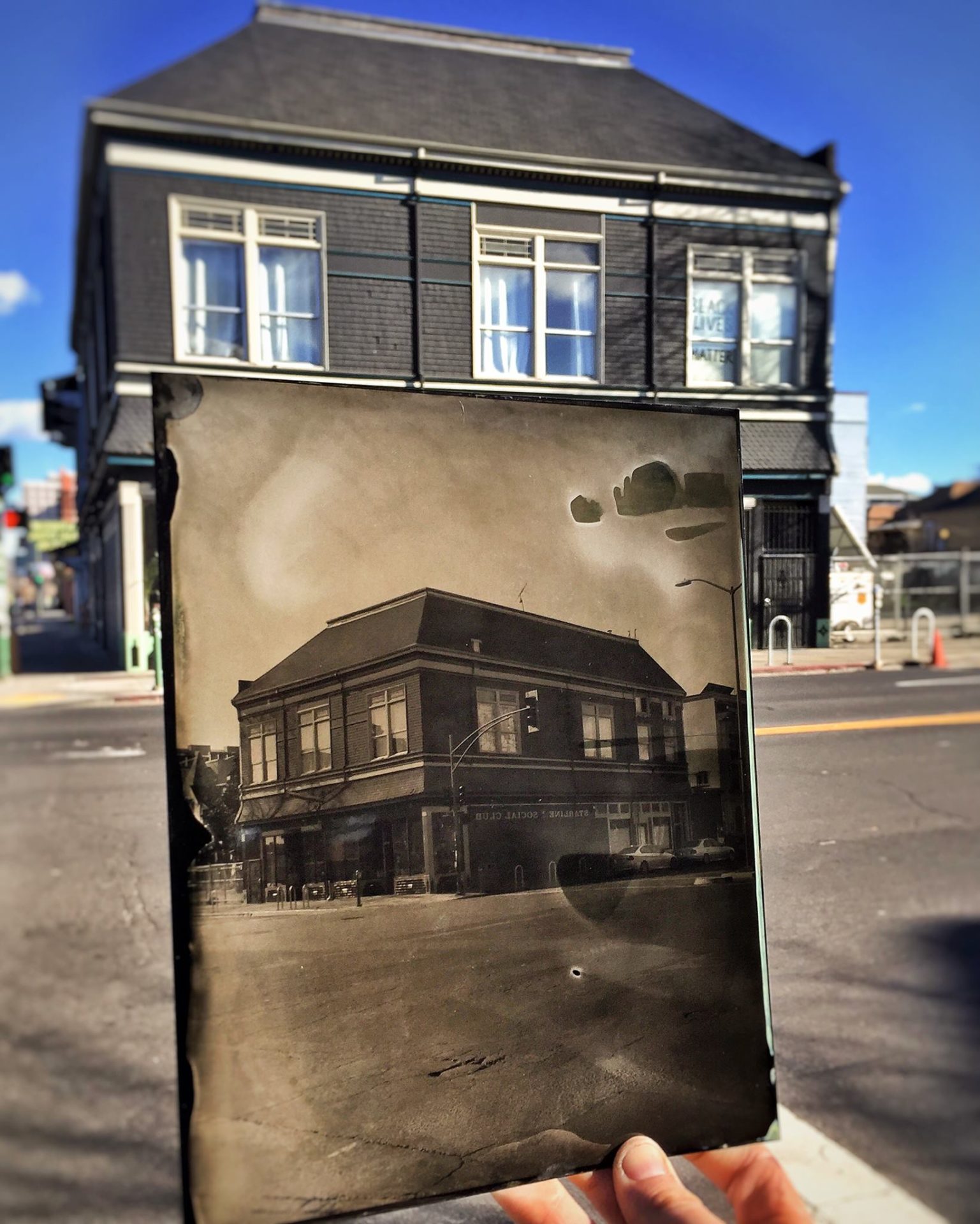

Capital Access was thrilled to help Rennu Dhillon, president and founder of Genius Kids, secure $2M through the SBA 504 program to purchase a 2,713-sf building in Fremont, CA. This was Rennu’s second SBA 504 loan through Capital Access Group.

Genius Kids is an award winning, accelerated learning center and franchise that focuses on providing children with the communication, confidence, and leadership skills that are essential for success in life. The original Genius Kids learning center, opened in 2001, has expanded to a total of eight schools operated by Genius Kids, Inc. Genius Kids Development, which runs the franchise operation, currently oversees 26 franchise units.

Property ownership is fundamental to Rennu’s business growth strategy, and the SBA 504 loan program, which features low down payment, fixed-rate, and long-term financing, was “very attractive.”

“I love real estate, and I would prefer to write my mortgage payment to a bank where I’m going to own the building and pay it off in 20 years rather than paying the money to a landlord. A building that generates revenue is the best investment one can make,” said Rennu.

“What I liked about the whole program is not the program as much as the people—working with the Capital Access Group team—they really guide you and advise you. They’re setting you up for success,” said Rennu.